Navigating the 20/3/8 Car Buying Rule: A Financial Roadmap.

What is the 20/3/8 Rule for Car Affordability?

Buying a car is a major financial decision, and it’s essential to do it right. While paying cash upfront is ideal, it’s not always feasible. That’s where the 20/3/8 rule comes in. This proven guideline can help you purchase a reliable vehicle without compromising your financial health.

Understanding the 20/3/8 Rule

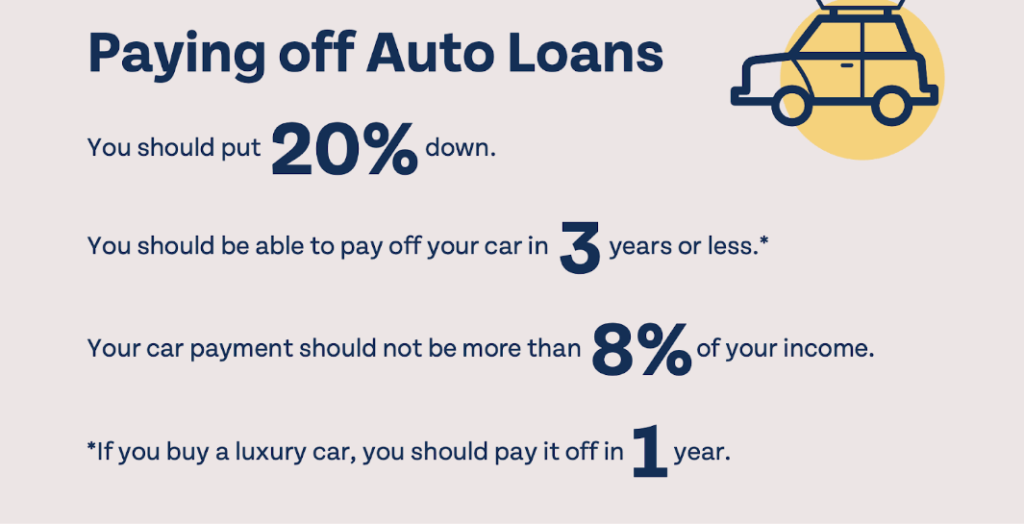

The 20/3/8 rule is a simple yet effective approach to car buying. It suggests:

- 20% Down Payment: Putting down 20% of the car’s price reduces the loan amount, lowering your monthly payments.

- 3-Year Loan Term: Aim for a loan term of three years or less. Shorter terms generally have lower interest rates, saving you money in the long run.

- 8% of Gross Income: Ensure your car payment doesn’t exceed 8% of your monthly gross income. This helps maintain a healthy balance between your car expenses and overall financial goals.

How Much Car Can You Afford?

Using the 20/3/8 rule, you can calculate how much car you can comfortably afford. For example, if you earn $5,000 per month, your maximum car payment should be around $400. This will help you stay within your budget and avoid financial strain.

Flexibility Within the Rule

While the 20/3/8 rule is a solid guideline, it’s not set in stone. If you’re struggling to meet these criteria, consider:

- Increasing Your Down Payment: Even a slightly higher down payment can significantly reduce your monthly payments.

- Shopping for Better Interest Rates: Compare rates from different lenders to find the most competitive deal.

- Choosing a Less Expensive Vehicle: Consider models that are a year or two older, base models, or vehicles with slightly higher mileage.

Comparing 20/3/8 to 20/4/10

Some people argue that the 20/3/8 rule is too strict. The 20/4/10 rule suggests a 20% down payment, a 4-year loan term, and a car payment not exceeding 10% of gross income. While this might seem more flexible, it’s important to consider the long-term financial implications.

Negotiating a Good Deal

Knowledge is power. Understanding your financial boundaries and the 20/3/8 rule can give you a significant advantage when negotiating at the dealership. Be prepared to walk away if you don’t get a fair deal.

Conclusion

The 20/3/8 rule is a valuable tool for responsible car buying. By following these guidelines, you can make a smart financial decision and enjoy your new vehicle without compromising your long-term financial goals. Remember, a well-planned car purchase can be a rewarding experience when done right.

Also Read:

- Understanding Car Liens: A Comprehensive Guide for Used Car Buyers

- Best Car Financing Options: Loans, Leases, and Rent-to-Own Explained

- Payday Loans: A Debt Trap to Avoid

- Navigating Personal Loans: A Comprehensive Guide