Understanding Payday Loans

Payday loans, often touted as quick financial fixes, can quickly turn into a debt trap. These short-term loans come with exorbitant interest rates and fees, making them a highly expensive way to borrow money. While they may offer immediate relief, the long-term consequences can be devastating.

Alternatives to Payday Loans

Before considering a payday loan, explore other options that offer more favorable terms. These include:

- Negotiating with Creditors: Reach out to your creditors and discuss payment plans or extensions.

- Emergency Savings: Building an emergency fund can provide a cushion for unexpected expenses.

- Credit Unions: Many credit unions offer small loans with lower interest rates than payday lenders.

- Government Assistance Programs: Explore government-funded programs that may provide financial aid.

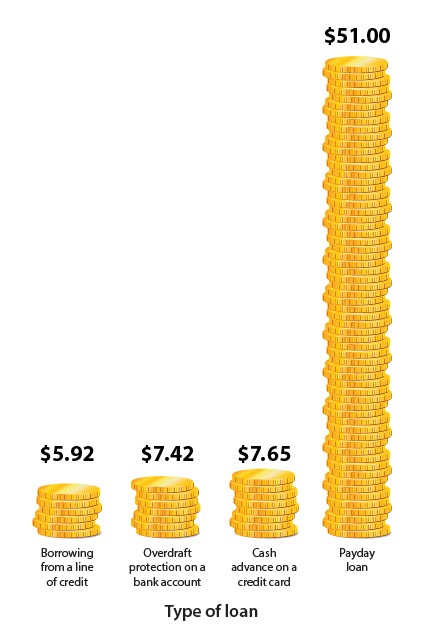

The High Cost of Convenience

Payday loans often entice borrowers with their ease of access and quick approval. However, the convenience comes at a steep price. The high interest rates and fees can quickly spiral out of control, leading to a cycle of debt.

The Dangers of Unlicensed Lenders

It’s crucial to be wary of unlicensed payday lenders. These unregulated entities may engage in predatory practices, making it even harder to escape the debt trap. Always verify the lender’s license before entering into any agreement.

Figure: A comparison of the costs of a credit line, overdraft protection on a checking account, and a credit card cash advance (based on a $300 loan for 14 days) with that of a payday loan.

Protecting Yourself from Payday Loan Pitfalls

- Understand the Terms: Carefully read and understand the loan agreement before signing.

- Calculate the Total Cost: Determine the total amount you’ll pay, including interest and fees.

- Create a Budget: Develop a budget to ensure you can afford the loan repayments.

- Seek Professional Help: If you’re struggling with debt, consult with a financial advisor or credit counselor.

Conclusion

While payday loans may seem like a tempting solution in times of financial hardship, they often lead to more problems than they solve. By understanding the risks and exploring alternative options, you can make informed decisions and avoid the pitfalls of these predatory loans.

Also Read:

- Understanding Car Liens: A Comprehensive Guide for Used Car Buyers

- 20/3/8 Car Buying Rule: Your Guide to Smart Vehicle Financing

- Navigating Personal Loans: A Comprehensive Guide

- Payday Loans: A Debt Trap to Avoid

- Best Car Financing Options: Loans, Leases, and Rent-to-Own Explained